Value Build Homes is not a “cookie-cutter” homebuilder. In fact, we work hard to be different. We specialize in building custom homes on your land in NC, working with you from inception through closing. And we can connect you with the best mortgage lenders in the industry, too!

Selecting the right lender for your situation is a critical part of the homebuilding process. We will work with you through every step in this process, using our access to new construction loan experts to help you get the best financing package possible so you can build your dream home.

How to Qualify for a Home Loan in North Carolina

North Carolina offers various programs that provide information, financial help, and other resources. The main things you need to do are: 1.) know what you can afford, and 2.) understand what kind of loans you can qualify for.

When it comes to knowing how much house you can afford, remember that in addition to buying the home, you need to have money set aside for maintenance & repairs, utilities, and emergencies. Also, lenders prefer a debt-to-income ratio less than 42%, so you’ll want to make sure you have as little debt as possible.

There are a variety of ways to finance a home in NC, including FHA loans, conventional loans, and grants. (The North Carolina Housing Finance Agency has assisted thousands of North Carolinians in purchasing homes with an array of financing options that make buying a new home affordable!)

But before you do anything else, it’s important to know where your credit stands. Don’t know what your credit score is? Check your credit score for free with Experian. If your credit score is 620 or higher, you’ll have a chance at getting approved for a conventional loan.

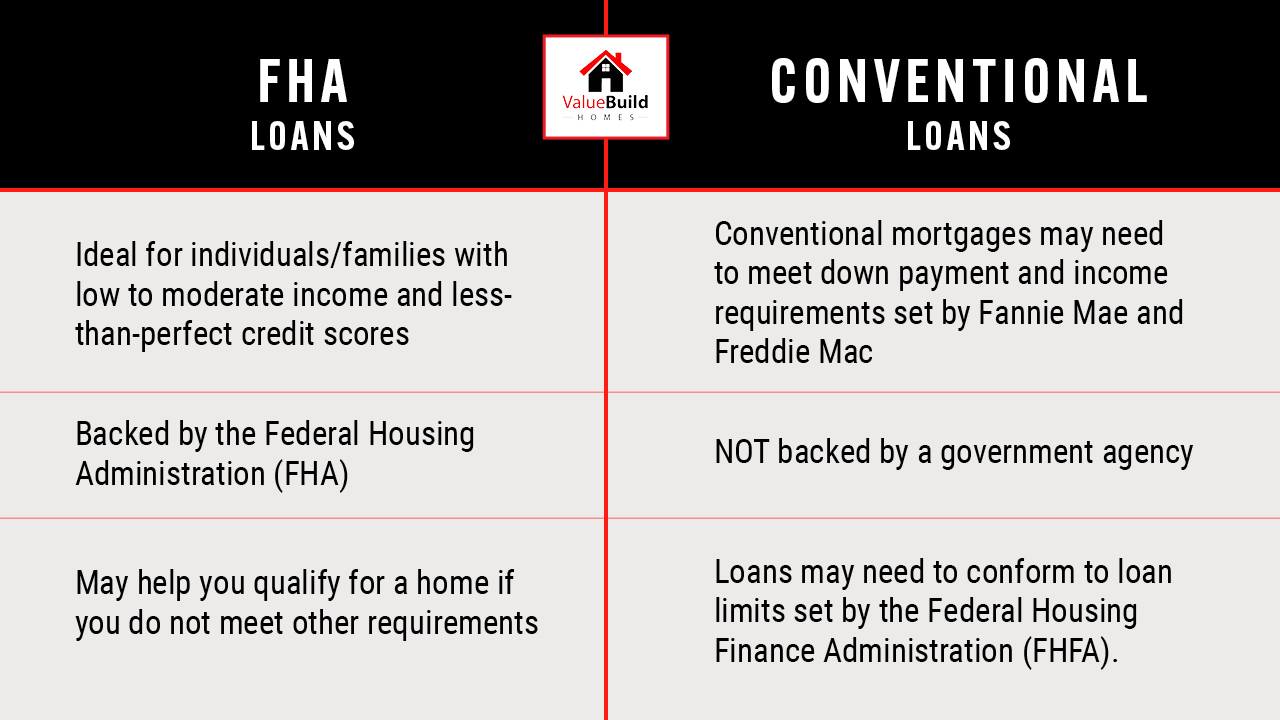

FHA loans are ideal for individuals and families with low to moderate income and less-than-perfect credit scores. They are backed by the Federal Housing Administration (FHA), and may help you qualify for a home if you do not meet other requirements.

Conventional loans (fixed-rate, adjustable-rate, conforming, non-conforming) are loans that are NOT backed by a government agency. Conventional mortgages usually need to meet down payment and income requirements set by Fannie Mae and Freddie Mac, and conform to loan limits set by the Federal Housing Finance Administration (FHFA).

For comparison: The down payment on an FHA loan is far less than a conventional loan, usually only about 3.5 percent. While a conventional loan often requires a score of 620 or above, with an FHA loan, you only need a score of at least 580 to qualify. If your score is between 500 and 579, you might still be able to get an FHA loan if you put 10 percent down.

Government-backed loans (FHA, VA, USDA) are helpful if you don’t have great credit or a sizable down payment. But if you have good credit or can put more money down, a conventional loan is probably a better choice. (The more money you put down, the lower your mortgage payment will be!) Compare the different options and their pros & cons to find the right loan for you.

Is Financing a New Construction Home Different from a “Used” Home?

In many ways, financing a new construction home is similar to getting a mortgage to buy a resale home. But there are some differences. For example, builders of new construction homes (like Value Build Homes!) may offer financing packages, either directly through our own mortgage subsidiary or a trusted local lender.

Additionally, there are unique loans that apply to new homes but not to resales, such as bridge loans and new-construction financing. These are used to fund the purchase and construction of a new home before the sale of your current home.

When choosing a lender, you want someone who understands and can guide you through the new construction process, give you loan options, and help you choose the one that suits your financial needs. For example, they can help you figure out if you need a construction loan.

Construction loans finance the building of the home. If you’re building a fully custom home, you’ll need a construction loan to cover the cost of the materials and labor to build the home before you occupy it. They are short-term loans, and they come in different variations, such as Construction-Only or Construction-to-Permanent. An experienced lender will be able to help you figure out how to afford a house in NC.

![]()

How To Finance A Home in NC

When it comes to financing a home in NC, the more educated and prepared you are, the faster and easier it will be. Gather your records in advance, know your credit score, brush up on the different financing options, and select the right lender for your situation. Call (919) 300-4923 or contact us to learn more about your financing options with Value Build Homes.