Mortgage rates have been rising lately, and you may be wondering whether to put your real estate plans on hold or charge ahead into the marketplace to build your dream home. The reality is that interest rates in a variety of markets, while they have certainly ticked up in recent months, are still close to historic lows.

If you decide to wait for a lender to offer you a better deal than you’re able to find right now, you may be waiting for quite a long time. The Federal Reserve has signaled that they intend to keep raising rates in an effort to stem the tides of rising inflation. Whether this plan will work or not remains to be seen, but it’s fairly certain that they intend to stick to their word for the foreseeable future.

As long as you understand what’s happening, you’ll be able to navigate the real estate market with ease during a period of rising rates and maybe even pick up the deal of a lifetime.

How Interest Rates Affect Real Estate Prices

While mortgage rates determine the amount of interest that you’ll pay each year as a percentage of your loan amount, these rates interact with the home’s absolute price to determine the absolute amount that you’ll need to set aside for monthly payments. In other words, you’ll pay substantially more per month on a $500,000 mortgage at a 3% interest rate than you’ll pay for a $250,000 mortgage at 7% APY.

What Happens To Home Prices As Interest Rates Rise?

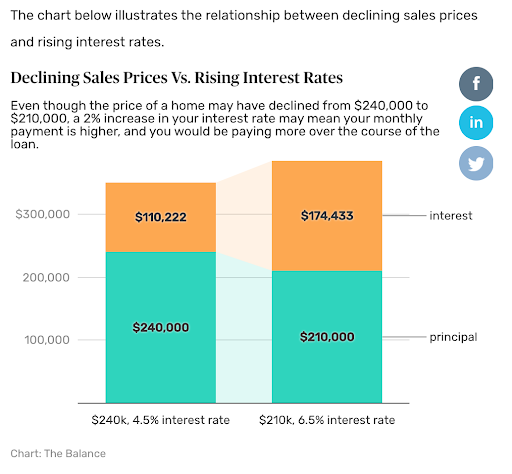

In general, when interest rates rise, prices decrease to compensate. However, your purchasing power may lessen as you pay more per month on a home with a lower price but a higher rate.

Even a fluctuation of 0.5% can make a significant difference over the life of a loan.

Getting a Mortgage May Become Tougher

Although home prices may decrease as rates rise, lending standards tend to increase and make attractive mortgage offers harder to come by. As many people found out the hard way in 2007 and 2008, when lenders increase standards, there is a very good chance that the mortgage offers you see today will not be available to you at the same terms in the future for quite some time.

If you have credit issues or anything else that you’re worried about financially speaking, talk to our Preferred Lenders about finding the best options for you! Overall, there are many good reasons to seize the opportunity and purchase a new Value Build home today.